Pre-settlement lawsuit funding and post-settlement lawsuit funding both offer financial support for plaintiffs in judicial proceedings. While they share many similarities, they also have some important differences. This post covers what you need to know about pre-settlement funding and post-settlement funding, including what they are, who qualifies, and when you may need them.

What Is Legal Funding?

If you’ve been seriously injured in an accident, you are likely experiencing new financial burdens. You may be facing expensive medical bills, costly property damage, months of lost wages, and even long-term nursing care.

Quality legal representation can help you seek compensation. However, not everyone can afford to pay up front. Thankfully, many personal injury lawyers work on a contingency fee basis, which means they deduct their legal fees from your eventual settlement or court award.

But how do you make ends meet in the meantime? That’s where legal funding comes in. Legal funding offers a cash advance against potential future compensation, providing a financial lifeline until your money comes through. Litigation funding trends suggest that legal funding is a small but growing financial sector.

Call For A Free Consultation

,

(855) 496-7121

What Do Pre- and Post-Settlement Funding Have in Common?

Pre-settlement funding and post-settlement funding both fall under the umbrella of legal funding. You may also hear it referred to as litigation funding, lawsuit financing, plaintiff funding, or lawsuit loans. However, pre- and post-settlement funding are not loans in the traditional sense. That’s because they offer non-recourse funding, which means you only repay the money if the case is resolved in your favor.

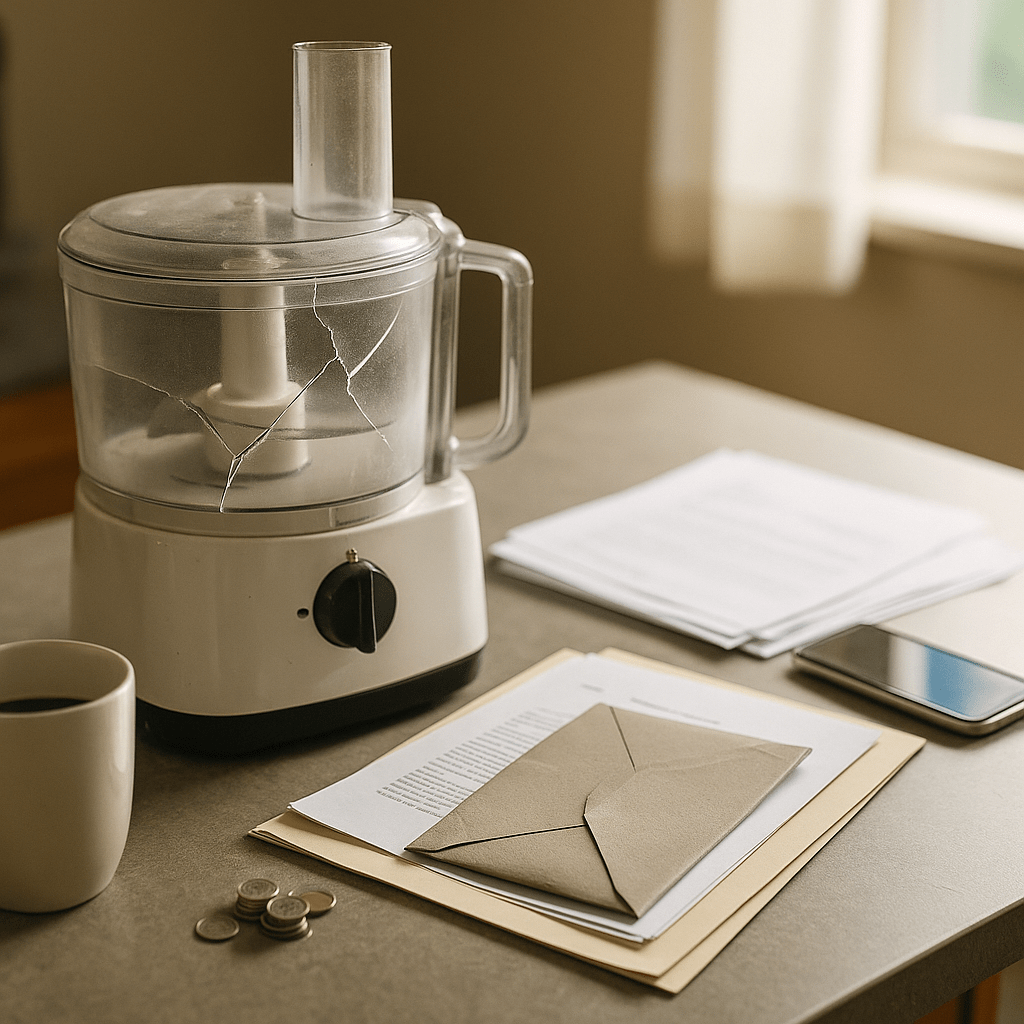

In addition, both funding types offer quick cash advances, with many lenders paying out in only one day. Neither type requires credit checks or income verification. Finally, you can generally use pre- and post-settlement funding on anything you like, including urgent medical expenses, overdue rent payments, pressing car repairs, or even a much-needed vacation.

How Do Pre- and Post-Settlement Funding Differ?

The principal difference between pre-settlement and post-settlement funding is the timing. Pre-settlement funding occurs during a legal action. You must typically have already retained an attorney but not yet resolved your lawsuit. Post-settlement funding, by contrast, happens after the lawsuit is over but before the funds have been distributed.

For this reason, the approval criteria are also different. When evaluating applications, post-settlement funding companies look at the following:

- Agreement terms

- Settlement amount

- Expected distribution timeline

For pre-settlement funding, however, the company doesn’t know exactly how much you could win. Therefore, it must evaluate factors like the following:

- The type of case: Personal injury, medical malpractice, product liability, and wrongful death claims tend to be more likely to qualify.

- The details of your claim: The funding firm will look at the stage of your case, the strength of your evidence, the severity of your injuries, and whether you were partly at fault for the accident.

- The expected settlement amount: The amount you seek for medical expenses, lost income, pain and suffering, and other economic and non-economic damages also factors into your approval chances.

- Quality of legal representation: If you are represented by a well-regarded lawyer with a successful track record, the likelihood of approval often goes up.

Apply For Free To Get The Money You Need Now.

When Is Pre-Settlement Funding or Post-Settlement Funding Suitable?

Pre-settlement and post-settlement funding are both suitable for a variety of claim types, including the following:

- Personal injury: You may qualify if you were hurt in a motor vehicle collision, bicycle crash, or accident involving public transportation.

- Premises liability: This category includes accidents such as slipping on a wet nursing home floor or tripping down poorly maintained stairs at a hotel.

- Medical malpractice: Examples include surgical mistakes, medication errors, and birth injuries.

- Product liability: These cases represent victims harmed by defective products, including medical devices, vehicles, and machinery.

In addition, you may find post-settlement funding useful in the following situations:

- Class-action lawsuits: These complex cases can have confusing distribution processes and extended settlement timelines.

- High-value settlements: Funding companies may be more likely to approve applications for high-dollar settlements.

- Lengthy settlement timelines: Just because your case is over doesn’t mean you’ll see the money right away. Procedural delays, bank processes, and unpaid liens can complicate distribution.

Get The Money You Need Now With Legal Funding. Apply Today

What Are the Pros and Cons of Pre- and Post-Settlement Funding?

Pre-settlement and post-settlement funding share some advantages and disadvantages:

Pros

- Simple application process

- Immediate access to funds, often in as little as 24 hours

- No limitation on how you spend them, from daily living expenses to emergency medical care

- Suitable for plaintiffs with poor credit since there is no credit check or income verification

- Less risky than traditional loans since they don’t require repayment until you receive the settlement or court award

Cons

- High fees and interest rates can lower your final settlement or award sum. Make sure to understand your repayment terms.

- The legal funding sector lacks the stringent regulation of traditional lending, making it even more important to choose a reputable firm.

Pre- and post-settlement funding also have a few unique advantages of their own:

- Pre-settlement funding: Because it helps you with medical costs, legal expenditures, and daily living expenses, pre-settlement funding relieves pressure on you and your attorney, giving you more time to strengthen your case and hold out for a better settlement.

- Post-settlement funding: Because the lender already knows the settlement amount or jury award, post-settlement funding tends to have higher approval rates and funding amounts.

Need Money Quickly? Contact Rockpoint Legal Funding Today!

Want to learn more about legal funding for plaintiffs? Check out our blog on legal funding options. Want to see if you qualify for pre-settlement funding or post-settlement funding today? Contact Rockpoint Legal Funding! Call (855) 582-9200 or contact us online to apply.

Disclaimer: Consumer legal fundings and advances are not loans under applicable financing laws. Rockpoint’s products are non-recourse, meaning if you don’t win your case, you don’t have to pay us back. Receiving financial support in connection with a legal case is typically (and oftentimes incorrectly) referred to as a “lawsuit loan” or “loan.” Therefore, for the ease of search references, these terms may be used in this context to refer to our funding products, but we maintain our separateness from consumer loan products in all legal aspects.

Apply Now For Free To

Get The Money You Need.

Presettlement Legal Funding.