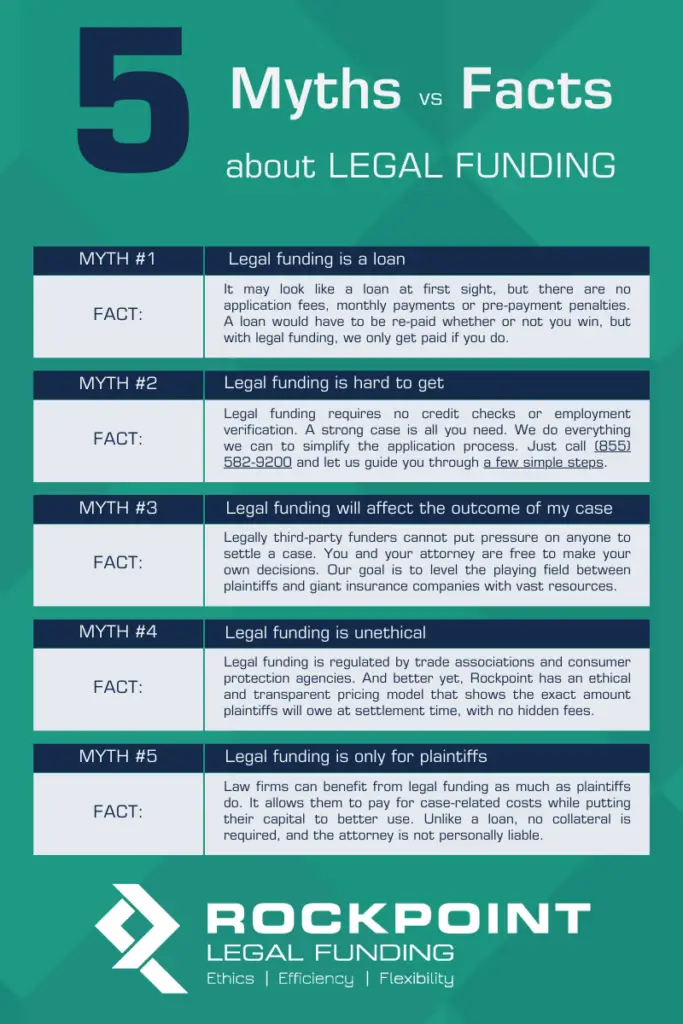

Below, find some myths and facts about legal funding. Read on!

Myth #1 – Legal funding is a lawsuit loan

It may look like a lawsuit loan at first sight, but there are no application fees, monthly payments or pre-payment penalties. A loan would have to be re-paid whether or not you win, but with legal funding, we only get paid if you do.

Myth #2 – Legal funding is hard to get

Legal funding requires no credit checks or employment verification. A strong case is all you need. We do everything we can to simplify the application process. Just call (855) 582-9200 and let us guide you through a few simple steps.

Myth #3 – Legal funding will affect the outcome of my case

Legally third-party funders cannot put pressure on anyone to settle a case. You and your attorney are free to make your own decisions. Our goal is to level the playing field between plaintiffs and giant insurance companies with vast resources.

Myth #4 – Legal funding is unethical

Call For A Free Consultation

,

(855) 582-9200

Legal funding is regulated by trade associations and consumer protection agencies. And better yet, Rockpoint has an ethical and transparent pricing model that shows the exact amount plaintiffs will owe at settlement time, with no hidden fees.

Myth #5 – Legal funding is only for plaintiffs

Law firms can benefit from legal funding as much as plaintiffs do. It allows them to pay for case-related costs while putting their capital to better use. Unlike a loan, no collateral is required, and the attorney is not personally liable.

Apply Now For Free To

Get The Money You Need.

Presettlement Legal Funding.