Article

Pre-Settlement Funding: Bridging the Gap Before Your Case Settles

Call for free evaluation

Available 24/7

Table of Content

On This Page

- What Is Pre Settlement Funding?

- Is Pre Settlement Funding Legal in Your State?

- How Can You Use Pre Settlement Funding To Tide You Over Before Your Settlement?

- How Pre Settlement Funding Works

- Attorney-Managed Repayment & Non-Recourse Protection

- Additional Flexibility

- Is Pre Settlement Funding Right for You?

- Frequently Asked Questions

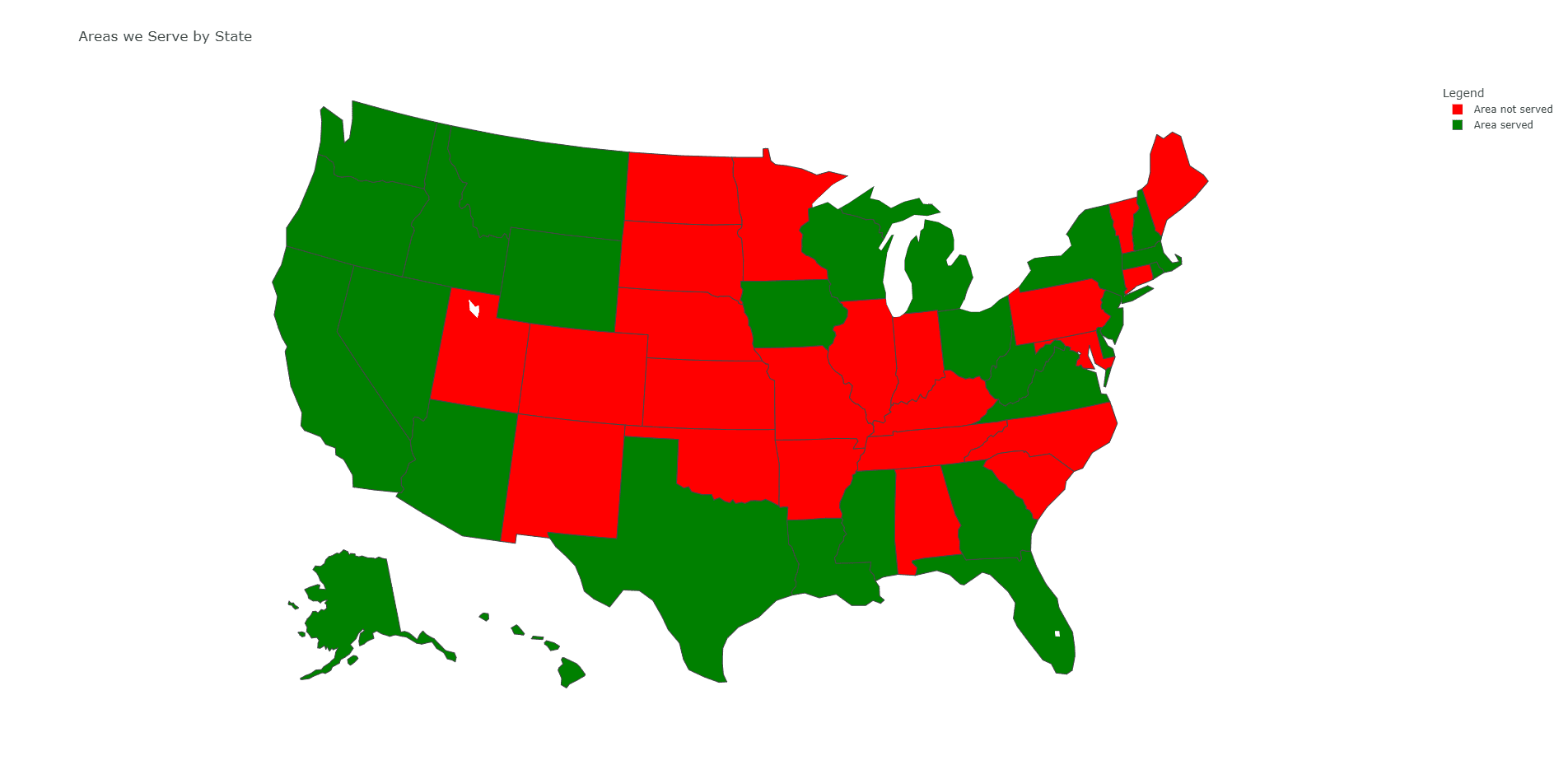

- Areas we Serve by State

- Apply for a Settlement Cash Advance Now

More Articles

Categories

You have a rock-solid personal injury case, and you’re sure that you’ll end up with a hefty check once the dust settles. The trouble is that you’re not sure when your case is going to wrap up, and you need that money now. Pre-settlement funding was made for plaintiffs like you.

What Is Pre Settlement Funding?

Pre-settlement funding is a cash advance on your lawsuit settlement. Instead of waiting for your settlement check, you can have access to the money right away. Litigation funding companies can typically provide funding in a couple of days or less.

Pre-settlement funding isn’t a loan. You won’t owe monthly payments, and there’s no interest to worry about. Instead, the funding company will take a percentage (typically 1% to 3%) of your settlement once your case is finished.

This is risk-free funding, too. If you lose your case, you don’t have to pay the funding back. That means you truly have nothing to lose.

Pre Settlement Funding vs. Traditional Bank Loans

- Credit check

Rockpoint Pre-Settlement Funding: None

Bank / Personal Loan: Required - Rockpoint Pre-Settlement Funding: None

- Bank / Personal Loan: Required

- Collateral

Rockpoint Pre-Settlement Funding: None

Bank / Personal Loan: Often required - Rockpoint Pre-Settlement Funding: None

- Bank / Personal Loan: Often required

- Repayment schedule

Rockpoint Pre-Settlement Funding: Single payment when case settles

Bank / Personal Loan: Monthly payments begin immediately - Rockpoint Pre-Settlement Funding: Single payment when case settles

- Bank / Personal Loan: Monthly payments begin immediately

- Recourse

Rockpoint Pre-Settlement Funding: Non-recourse — we can never pursue wages or assets

Bank / Personal Loan: Lender can garnish wages, seize assets - Rockpoint Pre-Settlement Funding: Non-recourse — we can never pursue wages or assets

- Bank / Personal Loan: Lender can garnish wages, seize assets

- Risk if you lose

Rockpoint Pre-Settlement Funding: $0 owed

Bank / Personal Loan: Balance still due - Rockpoint Pre-Settlement Funding: $0 owed

- Bank / Personal Loan: Balance still due

When you borrow against your own future recovery, you avoid the personal risk that comes with debt.

Call For A

Free Consultation

Is Pre Settlement Funding Legal in Your State?

Every state treats lawsuit funding a little differently. Some regulate the industry heavily, a few ban it outright, and many fall somewhere in-between. Rockpoint Legal Funding follows all applicable statutes and disclosure rules nationwide.

- Open & Unregulated

Meaning: Funding contracts are fully enforceable with no special caps or licensing.

Example states: TX, FL - Meaning: Funding contracts are fully enforceable with no special caps or licensing.

- Example states: TX, FL

- Regulated

Meaning: Statutes spell out interest/fee caps, rescission periods, and licensing.

Example states: CA, CO, OH - Meaning: Statutes spell out interest/fee caps, rescission periods, and licensing.

- Example states: CA, CO, OH

- Unclear / Silent

Meaning: Courts haven’t ruled decisively; contracts generally enforced under standard contract law.

Example states: PA, NJ - Meaning: Courts haven’t ruled decisively; contracts generally enforced under standard contract law.

- Example states: PA, NJ

- Restricted / Prohibited

Meaning: Funding contracts may be void or unenforceable.

Example states: MD; CO (workers-comp funding only) - Meaning: Funding contracts may be void or unenforceable.

- Example states: MD; CO (workers-comp funding only)

Quick check: Call (855) 582-9200 to confirm the rules where you live.

Legal Funding Is Available for Many Case Types

- Car and truck accidents

- Pedestrian & bicycle collisions

- Slip-and-falls & premises liability

- Dog attacks

- Medical malpractice & defective devices

- Wrongful death & survival actions

- Nursing-home negligence

- Construction & workplace accidents

- Jones Act & maritime injuries

- Product liability

- Employment & FLSA disputes

How Can You Use Pre Settlement Funding To Tide You Over Before Your Settlement?

Litigation funding companies, such as Rockpoint Legal Funding, place no restrictions on what you can do with your cash advance. Here’s how you can use your funding to tide you over during the key stages in a personal injury lawsuit.

Pay for Medical Expenses

If you’ve had a serious accident, your medical bills will likely keep growing long after you’ve left the emergency room. You might have to pay for surgeries, medical equipment, follow-up care, and physical therapy. Health insurance may cover some of these costs, but you could be on the hook for the rest.

You can use pre-settlement funding to pay for medical expenses, allowing you to stress less and focus on recovering.

Cover the Cost of Necessities

Did your accident leave you unable to work? You still have to pay bills and put food on the table, and your savings, no matter how significant, will run out eventually.

Pre-settlement funding is the perfect solution for those who are too injured to earn an income. You can use your funding for groceries, utility bills, school supplies, gas, and much more.

For individuals involved in employment disputes, pre-settlement funding can also help bridge the financial gap, especially when navigating the complexities of co-employment vs. joint employment arrangements, which often prolong settlement negotiations.

Pay Off Debt

Debt doesn’t stop racking up when you’re injured, and creditors are unlikely to be sympathetic to your plight. If you have student loans or credit card bills, pre-settlement funding can be a lifesaver. Use it to pay those bills down so the interest doesn’t balloon out of control.

Pay for Home Modifications

If your accident left you disabled, you might need to install home modifications, such as a stair lift, widened doorways, or wheelchair ramps. All of these can be incredibly expensive, and your insurance probably won’t pay for them. If it does, coverage is generally limited. Lawsuit funding helps you afford the modifications you need.

Legal Expenses Coverage

Lawsuits can drag on for many months, and some last more than a year. Do you have the funds to pay legal fees until your case settles? If not, keep your case going strong with pre-settlement funding.

Everyday Bills the Advance Can Cover

- Rent or mortgage

- Groceries & childcare

- Utility bills & phone service

- Vehicle payments & repairs

- Physical therapy & medical equipment

- Funeral and burial costs (wrongful-death cases)

Apply For Free To Get The Money You Need Now.

How Pre Settlement Funding Works

How Does Lawsuit Financing Work?

Applying for a non-recourse advance is a simple process. Here’s how it works:

- You’ll need to have a valid case type, such as one of those listed above. We’ve found these types of cases tend to have a high success rate for plaintiffs. Legal funding companies are more likely to provide a cash advance if their risk is limited.

- You will need to have an attorney’s representation before you qualify for pre-settlement funding. Your chances of winning your case, and a fair settlement, are higher with an attorney representing you. We’ll work with your attorney throughout the funding process.

- Fill out the quick application and we’ll tell you if you’re approved. You don’t owe us any money when you apply, and there’s no credit check, so your credit score will not be affected.

- Review the financing agreement with your attorney. It’s important for your lawyer to look over the agreement because ultimately, they are the one responsible for repaying your advance once the case settles.

- If approved, you could have your cash advance in as little as 24 hours or less. And remember, if your case doesn’t settle, you owe us nothing.

How We Calculate Your Advance & Funding Limits

Our underwriters review the facts, liability, and documented damages in your case, then estimate a conservative settlement value. We advance up to 20% of that figure—enough to relieve pressure without jeopardizing your eventual recovery.

Example – Projected settlement $250,000 ➜ Max advance $50,000

Credit scores never factor in—only the merits of your lawsuit.

Transparent Pricing: Flat Fees—Never Compounding Interest

With Rockpoint you’ll see a single, flat funding fee in your contract. No teaser rates, no daily accruals, no surprises. What you sign is what you pay—once, from the settlement proceeds.

Eligibility Checklist

- You have a valid personal-injury or employment claim.

- You’re represented by an attorney working on contingency.

- Liability is reasonably clear.

- The defendant has insurance or assets to pay.

Approval can happen in as little as 24 hours.

Get The Money You Need Now With Legal Funding. Apply Today

Attorney-Managed Repayment & Non-Recourse Protection

How Repayment Works

- Settlement or verdict is reached.

- Defendant/insurer sends a check to your lawyer’s trust account.

- Your lawyer repays Rockpoint directly.

- Attorney deducts case costs and fees.

- Remaining funds are wired to you.

100 % Non-Recourse—Your Personal Assets Are Safe

If your case doesn’t produce a recovery, you owe us nothing. We can never:

- Garnish wages

- Levy bank accounts

- Place liens on property

That guarantee is written into every contract.

Additional Flexibility

Need More Funds? Second & Subsequent Advances

If your case drags on and you’re still within the 20 % cap, you can request an additional advance. Approval is fast because we already know your file.

Funding After a Wrongful Death—Support for Surviving Families

Funeral costs, final medical bills, and lost income can devastate a family. Rockpoint offers non-recourse advances to qualified spouses, children, or estate representatives so they can keep the lights on while justice runs its course.

Is Pre Settlement Funding Right for You?

Not sure pre-settlement funding makes sense for your legal case? If your case is simple and you expect it to settle quickly, you may not need legal funding. But if your case is taking a long time to settle, a cash advance could be just what you need to bridge the gap until your settlement check arrives.

Consider pre-settlement funding if:

- The insurance company is dragging out negotiations

- You have medical expenses and other bills you need to pay now

- You want to hold out for the fairest possible settlement

Leveling the Playing Field Against Insurance Delay Tactics

Insurers know financial pressure forces quick, low-value settlements. A Rockpoint advance buys you time to wait out stall tactics, empowering your attorney to negotiate for the full value of your claim.

Frequently Asked Questions

Can I apply more than once?

Yes—provided your total advances stay within 20% of expected case value.

Does this affect my credit score?

No. We never run credit or report to bureaus.

How long does approval take?

Most applicants receive a decision the same day and funds within 24 hours.

What happens if I switch attorneys?

Just let us know your new lawyer’s contact information; funding terms stay the same.

Will this hurt my settlement?

No. Advances are structured so that you still receive the majority of any recovery

Areas we Serve by State

Apply for a Settlement Cash Advance Now

Paying for medical treatment with legal funding can take a serious load off your back. Instead of worrying about going into debt, you can focus on feeling better.

When you work with Rockpoint Legal Funding, we make it easy to apply for pre-settlement funding. You’ll enjoy no hidden fees, exceptional customer service, and a team that truly cares about your case.

For your free consultation, call us at (855) 582-9200.

Disclaimer: Consumer legal fundings and advances are not loans under applicable financing laws. Rockpoint’s products are non-recourse, meaning if you don’t win your case, you don’t have to pay us back. Receiving financial support in connection with a legal case is typically (and oftentimes incorrectly) referred to as a “lawsuit loan” or “loan.” Therefore, for the ease of search references, these terms may be used in this context to refer to our funding products, but we maintain our separateness from consumer loan products in all legal aspects.

Apply Now For Free To

Get The Money You Need.

Presettlement Legal Funding.

Never settle for less. See how we can get you the funds you need today.

Call for free evaluation Available 24/7