Location

Financiamiento Pre-Asentamiento y Legal del Condado de Riverside

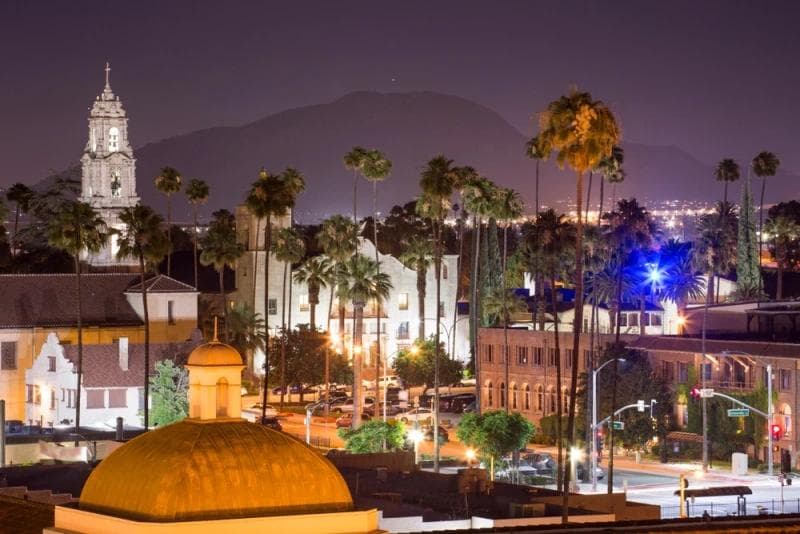

Legal Funding in The Birthplace of Southern California's Citrus Industry

Llama para una evaluación gratuita

Disponible 24/7

Finding Lawsuit Loans in Riverside County, California

If you’re facing financial strain while awaiting the resolution of your legal case in Riverside County, California, a lawsuit loan may be a viable option for you. This article aims to guide you through the process of finding and obtaining a lawsuit loan in Riverside County.

Llama Para Una

Consulta Gratuita

Understanding Lawsuit Loans

Before delving into the details of finding lawsuit loans in Riverside County, it’s crucial to grasp the concept of a lawsuit loan itself. Simply put, a lawsuit loan, also known as a pre-settlement loan or litigation funding, is a financial arrangement in which a company provides funds to a plaintiff in exchange for a portion of their potential settlement. It allows individuals involved in legal battles to access money before their case concludes, alleviating the financial burden that often accompanies lengthy lawsuits.

What is a Lawsuit Loan?

A lawsuit loan is not technically a loan in the traditional sense. Instead, it is a cash advance based on the estimated value of your pending legal case. Unlike traditional loans, lawsuit loans are non-recourse, meaning you only repay the borrowed amount if and when you win your case. If you lose your case, you typically owe nothing to the lawsuit loan company.

When considering a lawsuit loan, it’s important to understand that the amount you can borrow is contingent upon the strength of your case and the potential settlement amount. The loan company will evaluate the merits of your lawsuit and estimate the likelihood of success. This evaluation process ensures that the loan provider is making a sound investment and that you, as the plaintiff, have a reasonable chance of receiving a favorable outcome.

Benefits of Lawsuit Loans

There are several advantages to obtaining a lawsuit loan in Riverside County. First and foremost, it provides financial relief during the litigation process, enabling you to cover medical bills, living expenses, and litigation fees. Lawsuit loans also level the playing field, as they allow you to withstand lengthy legal battles without being forced into accepting low settlement offers.

Furthermore, lawsuit loans can help you maintain your quality of life while your case is ongoing. Lawsuits can be time-consuming, and the financial strain can be overwhelming. With a lawsuit loan, you can focus on your case without worrying about how to make ends meet. This financial stability can also give you the peace of mind needed to make informed decisions about your legal strategy.

Additionally, the non-recourse nature of these loans eliminates the risk of personal liability in the event of an unsuccessful lawsuit. If you do not win your case, you are not obligated to repay the loan. This feature provides a safety net for plaintiffs, allowing them to pursue justice without the fear of financial ruin.

Risks and Considerations of Lawsuit Loans

While lawsuit loans can be beneficial, it’s important to consider the potential risks involved. Lawsuit loan companies often charge high interest rates and fees, which can significantly reduce your final settlement amount. It’s crucial to carefully review the terms and conditions before accepting any funding.

Furthermore, it’s essential to choose a reputable and trustworthy loan provider like Rockpoint Legal Funding. Since lawsuit loans are not regulated like traditional loans, there is a risk of encountering unscrupulous companies that take advantage of vulnerable plaintiffs. Researching and selecting a reputable loan provider will help ensure that you receive fair terms and transparent communication throughout the process.

Lawsuit loans can provide much-needed financial relief and stability during the litigation process. Understanding the concept of a lawsuit loan, its benefits, and potential risks is essential for making an informed decision. By carefully evaluating the terms and conditions, selecting a reputable loan provider, and consulting with your attorney, you can navigate the world of lawsuit loans with confidence.

Financiamiento Legal

Cerca de Mí

We’re in your town:

- Banning

- Beaumont

- Blythe

- Calimesa

- Canyon Lake

- Cathedral City

- Coachella

- Corona

- Desert Hot Springs

- Eastvale

- Hemet

- Indian Wells

- Indio

- Jurupa Valley

- Lake Elsinore

- La Quinta

- Menifee

- Moreno Valley

- Murrieta

- Norco

- Palm Desert

- Palm Springs

- Perris

- Rancho Mirage

- Riverside

- San Jacinto

- Temecula

- Wildomar

Aplica Gratis Para Obtener el Dinero que Necesitas Ahora.

How to Qualify for a Lawsuit Loan in Riverside County

While eligibility criteria may vary among lawsuit loan providers, it’s essential to have a general understanding of the requirements for obtaining a lawsuit loan in Riverside County.

Eligibility Criteria for Lawsuit Loans

In general, lawsuit loan providers consider factors such as the strength of your case, the likelihood of winning a settlement, and the potential settlement amount. The exact criteria may vary, but most providers will assess the merits of your case and work with your attorney to evaluate its viability for funding.

Required Documentation for Lawsuit Loans

When applying for a lawsuit loan, you will typically need to provide documentation related to your case. This may include your attorney’s contact information, copies of relevant legal documents, medical records, police reports, and any other evidence supporting your claim. Gathering these documents in advance can streamline the application process.

Obtén el Dinero que Necesitas Ahora con Financiamiento Legal. Aplica Hoy

Choosing the Right Lawsuit Loan Provider

With numerous lawsuit loan providers available in Riverside County, selecting the right one for your needs requires careful consideration.

Factors to Consider When Choosing a Provider

When evaluating lawsuit loan providers, it’s crucial to consider factors such as their reputation, experience in the industry, customer reviews, and the terms and fees associated with their loans. Researching multiple providers and comparing their offerings will help you make an informed decision.

Understanding Interest Rates and Fees

Lawsuit loan providers typically charge an interest rate and fees for their services. It’s essential to understand the terms of the loan, including the interest rate, any upfront fees, and any other charges associated with the funding. Carefully review the terms and ask questions to ensure you fully comprehend the financial implications.

Rockpoint’s patient and compassionate Customer Care Team takes the time to go through the terms of every funding contract, ensuring that the plaintiff understands the document and has an opportunity to have all their questions answered. What’s more, Rockpoint’s contracts include an easy-to-read payment schedule table right on each and every funding contract document.

The Application Process for Lawsuit Loans

Once you’ve selected a suitable lawsuit loan provider, it’s time to begin the application process.

Step-by-Step Guide to Applying

The application process usually begins by contacting the loan provider and expressing your interest in obtaining a lawsuit loan. They will guide you through the necessary steps, which may include submitting relevant documentation, completing an application form, and obtaining your attorney’s cooperation. Stay in close communication with the provider throughout the process to provide any additional information or clarification they require.

What to Expect After Applying

After submitting your application, the loan provider will review your case and the supporting documentation. They may consult with your attorney to assess the strength of your case and determine the potential settlement amount. If approved, you will receive the funding, typically within a few days. Remember to carefully review the terms of the loan agreement before accepting the funds.

By navigating the complexities of finding lawsuit loans in Riverside County, you can alleviate financial stress and maintain stability while awaiting the resolution of your legal battle. If you are interested in learning more about legal funding or want to apply for funding, contact Rockpoint Legal Funding or submit an online application today.

Aplica Ahora Gratis Para

Obtener el Dinero que Necesitas.

Financiamiento Legal Previo al Acuerdo.

Google Reviews

No reviews available

No te conformes con menos. Mira cómo podemos conseguirte hoy los fondos que necesitas.

Llama para una evaluación gratuita Disponible 24/7